Great service & competive price

We confident with the service as we will not just take your money and walk away after. We will always be there for you every single steps of the way. If you have problems or questions simply give us a call or send us a text. I get back to you!

We are not here to compete our prices to others who firms or individual what they maybe offer you. We are here to provide you the service you deserve and the time each customer required.

"Excellent customer service is the number one job in any company! It is the personality of the company and the reason customers come back. Without customers there is no company!" - By Connie Edler

Call us on 01923 519829 for more information.

Our Services

Konsio Consulting Service Ltd offer variety of services to sole traders, small-to medium sized business. We are specialists in accounting, book-keeping, payroll, business advice, business start up. You need to have a viable business idea. You must also have what it takes to make it work. You also must have enough money to start your business get by until your business starts to generate enough money. A little bit of luck every now and again also helps – as does knowing you have the support of your friends, family and others.

Call us at 01923 519829 we can help.

Business start-up/ formation

From business plan to company formation. We cover all. With nearly 20 years experience in the business, we confident we can help you to develop your idea and turn your idea to reality. Having the right guidance is the key to success.

Company Tax

Taxable profits for Corporation Tax include the money your company or association makes from: doing business ('trading profits'); investments; selling assets. We can help you all. Paying the right amount of tax and comply with all necessary tax regulations.

Financial Statement

Company accounts are a summary of an organization's financial activity over a 12 month period. They are prepared for Companies House and HM Revenue & Customs every year and consist of the Balance Sheet, the Profit and Loss Statement.

Self-Assessment

Self Assessment is a system HM Revenue and Customs ( HMRC ) uses to collect Income Tax. Tax is usually deducted automatically from wages, pensions and savings. People and businesses with other income must report it in a tax return.

Self-employed

When you're self-employed, you pay income tax on your trading profits – not your total income. To work out your trading profits, you have to deduct your business expenses and other allowable expenses.

Foreign Landlord Tax

If you live abroad for 6 months or more per year, you’re classed as a ‘non-resident landlord’ by HM Revenue and Customs (HMRC) - even if you’re a if you UK resident for tax purposes.

PAYE/ NICs

Pay As You Earn (PAYE) is a system required by HM Revenue & Customs (HMRC) under which employers deduct from their employees wages an amount of income tax, national insurance contributions (NICs), student loan repayments, pension in accordance with PAYE codes.

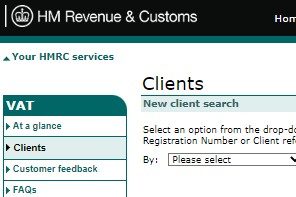

VAT

VAT or flat rate VAT is a tax added to most products and services sold by VAT -registered businesses. Businesses have to register for VAT if the turnover is over £90,000. VAT is normally report quarterly or annually.

Bookkeeping

Bookkeeping service is the practice of recording and keeping track of financial transactions of your business. The bookkeepers are required to summarize the activity of your business regularly into financial reports.